This month, we will look at the latest trends and movements in the world of financial compliance and track the up-to-date developments within the global AML/KYC space, with all the most recent regulatory implementations and updates addressed and dissected.

2022 is sure to see a plethora of further regulatory change with even more risk and potential for financial crime being imposed on banks. With that in mind, it’s never been more vital for financial institutions to ensure they’re on top of all their regulatory requirements and responsibilities.

Read on, for all the very latest key market updates, trends, and industry leader insights that you need to know this month.

It comes as no big surprise that the FCA did not significantly alter the Consumer Duty’s core provisions after its second consultation. The FCA has maintained its commitment to all fundamental principles and the intent of the Consumer Duty in the wake of an unprecedented level of industry engagement and feedback, but it has also demonstrated that it was paying attention by making a number of changes to its rules and offering additional guidance.

The financial services industry is crucial to the UK economy, and the Financial Services and Markets Bill is essential to realising the government’s vision of a transparent, environmentally friendly, and technologically advanced financial services industry that is competitive on a worldwide scale.

In general, the bill is stated to make use of the benefits of the EU Exit by customising financial services regulation to UK markets to increase the UK’s competitiveness as a global financial center and produce better results for both businesses and consumers.

Here is all you need to know about what the new measure will focus on.

The Financial Conduct Authority (FCA) has announced that it intends to implement a new Consumer Duty that would significantly enhance how businesses interact with customers. It would establish stricter guidelines for consumer protection across all financial services and mandate that businesses put the needs of their clients first.

There has been a global increase in AML regulations as the fight against financial crime intensifies across global borders. With increased sanctions, new age threats, need for stronger risk detection, monitoring, and risk profiling, compliance teams in banks will need to adopt stronger defence models to combat the rise in financial crime.

Financial Crime and Compliance teams will be aware of the difficulty AML and Customer Due Diligence (CDD) efforts can bring, and the dense web of requirements to follow. With automation technology constantly evolving and laws and regulations shifting to become more robust, teams will need to ensure that they are taking a resilient stance on financial crime. As criminals adopt new methods to infiltrate compliance weaknesses, financial crime and compliance teams in Australia and New Zealand will need to increase the talent and systems to ensure that resilient and robust processes are implemented to avoid hefty fines and reputational damage.

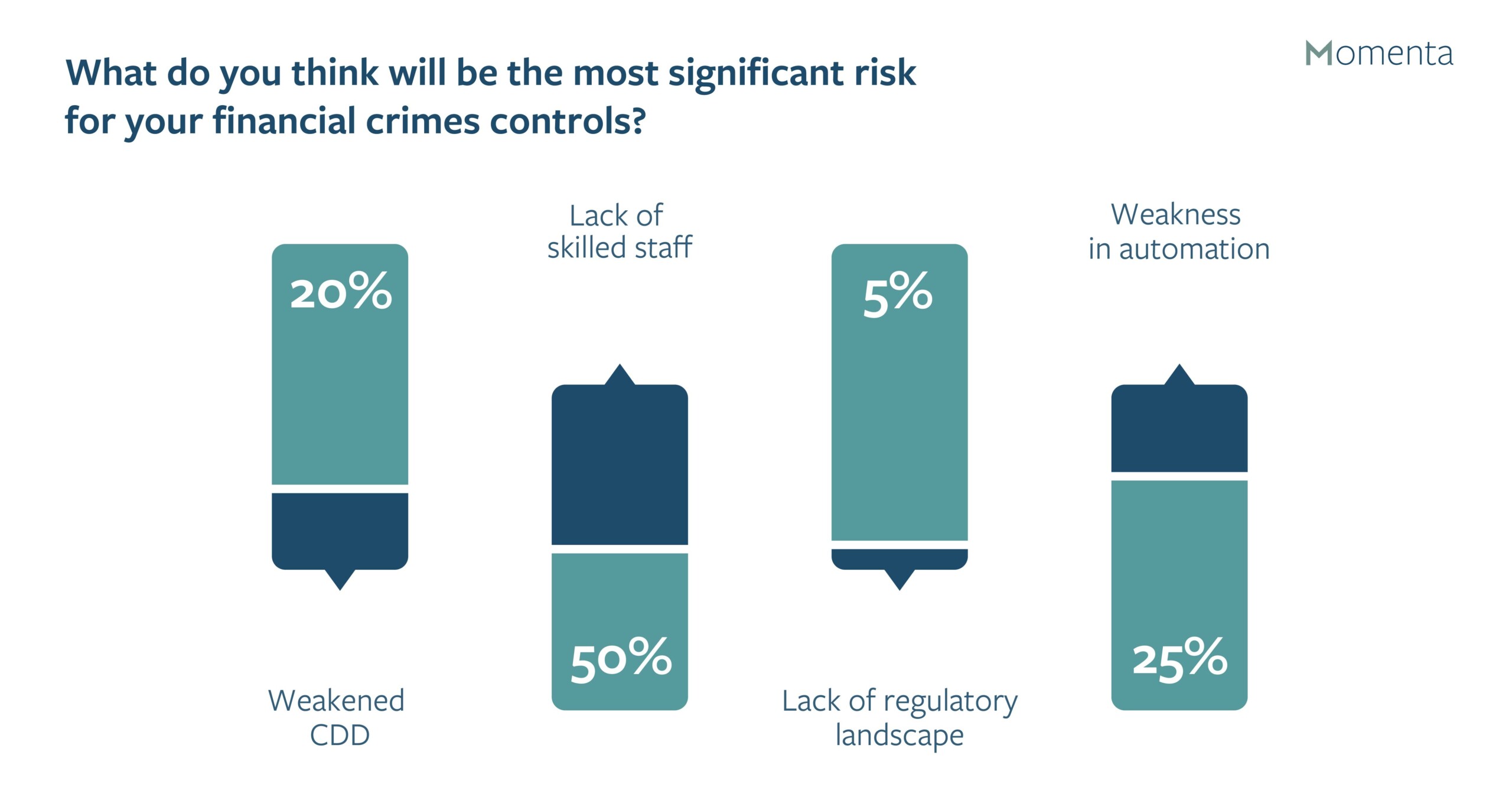

We asked our global community what they thought their most significant risk was when it came to financial crime control.

The results showed that 51% of respondents felt that a lack of trained staff was the most significant risk.

The post-COVID-19 world will present enormous amounts of opportunities for those who are prepared, and many are starting their preparations to transition into new market norms now, by equipping themselves with flexible, experienced, and effective contingent workforces.

To find out how Momenta can help you with your contingent workforce planning and resourcing, contact us today.