This month, we will look at the latest trends and movements in the world of financial compliance and track the up-to-date developments within the global AML/KYC space, with all the most recent regulatory implementations and updates addressed and dissected.

2022 is sure to see a plethora of further regulatory change with even more risk and potential for financial crime being imposed on banks. With that in mind, it’s never been more vital for financial institutions to ensure they’re on top of all their regulatory requirements and responsibilities.

Read on, for all the very latest key market updates, trends, and industry leader insights that you need to know this month.

The European Union (EU) is implementing the Digital Operational Resilience Act (DORA), which was announced as part of the new Digital Finance Strategy, to harmonise Information and Communications Technology (ICT) risk regulations across Europe.

The European Union is taking a firm stand to increase the financial sector’s resilience to ICT-related major incidents. With prescriptive requirements for both financial entities and vital ICT service providers, as well as an ambitious compliance deadline (scheduled for the end of 2022), businesses must begin planning immediately.

DORA also fits into a global trend in financial sector regulation that began with the Bank of England’s (FCA and PRA) consultation papers on operational resilience and impact tolerances and has since been followed by principle-based operational resilience papers from the Bank of International Settlements (BIS) and the Federal Reserve.

The future of the workforce is a trending topic for multiple industries, as new workforce norms are being defined. Many organisations especially those in financial services are asking how they can prepare for the future of work. Given the current market’s unpredictability, understanding the new patterns and trends will be key, especially for compliance departments facing additional pressures from regulators.

The COVID-19 epidemic has resulted in a significant rise in consumer digital interactions, opening up new opportunities but also increasing operational and market dangers, many of which are related to fraud and financial crime.

Here are some thoughts on the most significant influences on the contingent landscape’s outlook of the future of work, as well as what organisations should consider as they plan their future roadmap.

The BNPL industry is expected to reach US$ 3268.26 billion by 2030 [1], with a CAGR of 43.8 % from 2021 to 2030, and has no signs of slowing down. Global consumer groups have raised concerns demanding for the buy-now, pay-later (BNPL) industry to be regulated, citing that as the cost of living rises, more customers may become trapped in debt as they turn to BNPL services to help with increasing financial pressures.

Despite the fact that BNPL services are known for their accessibility and flexibility, unregulated BNPL services can sometimes put consumers’ financial well-being and stability at risk. Choice, Financial Counselling Australia, and the Consumers’ Federation of Australia are among the alliance members that have issued a “global statement” outlining six fundamental prerequisites for effective BNPL regulation [2].

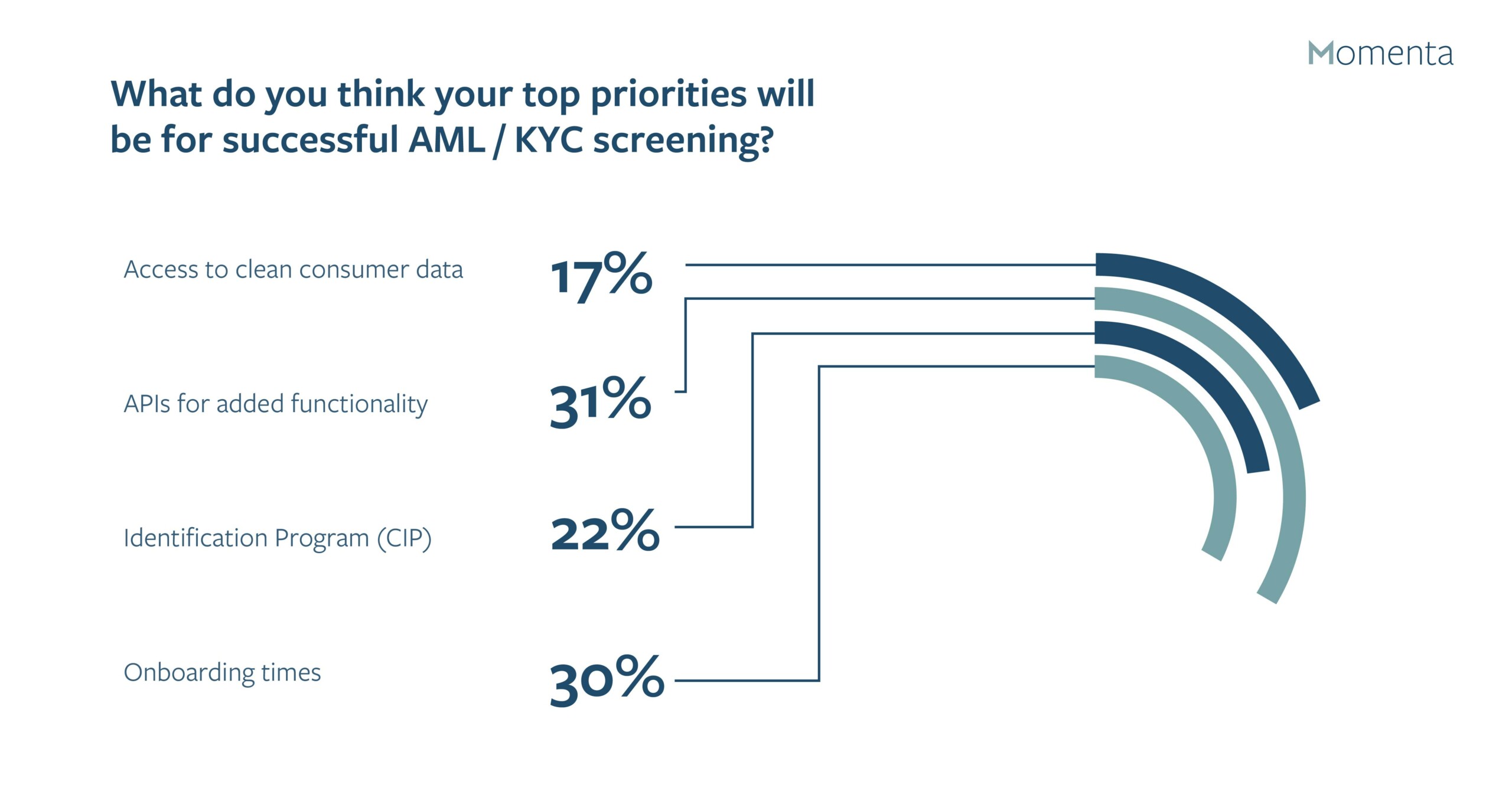

We asked our global community what they thought top priorities would be for successful AML/KYC screening.

The results showed that 31% of respondents believe that APIs for added functionality was the biggest priority for internal teams.

The post-COVID-19 world will present enormous amounts of opportunities for those who are prepared, and many are starting their preparations to transition into new market norms now, by equipping themselves with flexible, experienced, and effective contingent workforces.

To find out how Momenta can help you with your contingent workforce planning and resourcing, contact us today.