This month, we will look at the latest trends and movements in the world of financial compliance and track the up-to-date developments within the global AML/KYC space, with all the most recent regulatory implementations and updates addressed and dissected.

2022 is sure to see a plethora of further regulatory change with even more risk and potential for financial crime being imposed on banks. With that in mind, it’s never been more vital for financial institutions to ensure they’re on top of all their regulatory requirements and responsibilities.

Read on, for all the very latest key market updates, trends, and industry leader insights that you need to know this month.

It’s often very difficult to make forecasts in the fight against financial crime, with new tactics and methods of avoidance emerging all the time.

Any regulatory changes that aid financial institutions in combating financial crime should of course be warmly embraced, and to stay ahead of the game, financial institutions must assess their technology, processes, and resourcing to ensure that they can deal with potential risks effectively.

With that in mind, and as we enter a new year, what will be the trends or developments that compliance teams can expect to see this year, and how can a contingent workforce ensure your compliance function is up to date with the ever-changing regulatory requirements, whilst remaining also as risk proof as possible?

There is no dispute that reputational damage within any industry for any business can have serious negative repercussions on the company’s bottom line.

Understanding the long-term repercussions of reputational damage will be vital for UK Banks and other lending businesses, especially amongst those allocating teams of staff to spearhead their recovery efforts in the collection of COVID backed loans.

Read the full white paper to discover the key findings and concerns highlighted by leaders and experts within the collections industry, as well as learn areas for you to consider when implementing measures to combat reputational disrepute through collection efforts.

The FCA, the Bank of England, and foreign authorities have now completed the final steps to phase out LIBOR, a trillion-pound interest rate benchmark used in a multitude of global financial transactions.

However, there remains a small number of contracts that could not be modified before the deadline.

The Financial Services Act of 2021 and accompanying FCA regulation are the result of an extensive study to find and recommend a legal solution for these contracts. For many, securing this large safety net for most legacy LIBOR contracts after year-end was the final element in ensuring a seamless transition and avoiding a cliff-edge scenario.

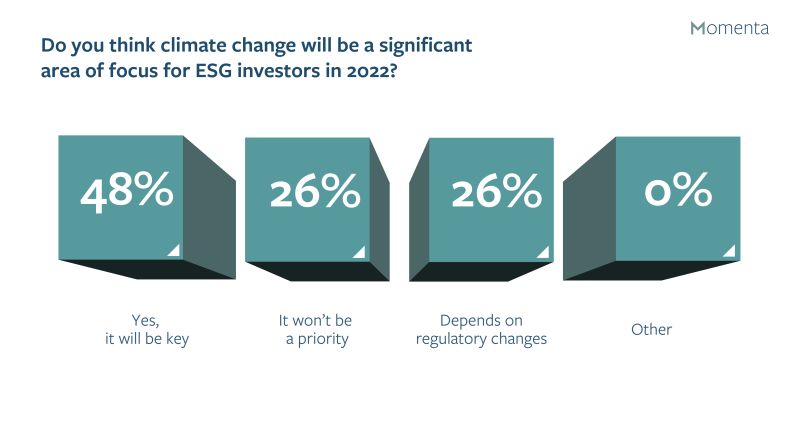

In our latest poll on ESG, we asked if you thought climate change would be a significant area of focus for investors. A majority of almost half said yes, it would be a key area.

The results from our recent poll on AML shows that 38% of voters said the main gap they needed to fill was improved CDD.

Ensuring any gaps are identified will be key for firms this year as regulators place more pressure on financial service participants to strengthen current compliance systems and controls.

The post-COVID-19 world will present enormous amounts of opportunities for those who are prepared, and many are starting their preparations to transition into new market norms now, by equipping themselves with flexible, experienced, and effective contingent workforces.

To find out how Momenta can help you with your contingent workforce planning and resourcing, contact us today.