This month, we will look at the latest movements in the LIBOR transition process, including the LIBOR Legislation Bill being passed by New York State, and the need for your business transitional efforts to be increased before LIBOR cessation.

Additionally, we will hone in on the immense amount of movement within the global AML/KYC space, with all new regulatory implementations and updates addressed and dissected.

Read on, for the key market updates, trends, and industry leader insights that you need to know this month.

Compliance teams have, it is fair to say in recent times, had a seemingly never-ending array of differing pressures bestowed upon them, from the global pandemic to the vast number of regulatory changes that are continually being passed by regulators and governments across the world.

One of the biggest issues arising from these scenarios is often adjusting to new norms and doing so in a manner that is efficient, as well as embedding behavioural change within organisations.

With backlogs of workloads often resulting, many businesses are increasingly turning to automated systems in the hope that they can place fewer pressures on internal teams, whilst streamlining processes and productivity at the same time.

Some of the latest compliance automation trends include the adoption of EKYC systems. However, many within the compliance and regulatory industry question whether these systems of digital transformation, such as AI and EKYC, can realistically solve KYC compliance constraints?

Read on, to discover the benefits and challenges that an automation adoption approach can present, and why a people + technology approach is the method of choice of for successful adoptees.

We recently sat down with Industry Leader Marcus Morton, Managing Director Valuation Services, Duff & Phelps.

In our fascinating discussion, Marcus gave us his industry-insider views regarding all things LIBOR transition, including the importance of starting your transitional efforts now, and the key process updates that all businesses need to be aware of and preparing for in equal measure.

In the US, the LIBOR Legislation Bill has recently been passed by New York State, raising hopes of a smoother transition for tough legacy contracts in the US. In this latest Momenta insight, we dig deeper into the detail of the bill, and what it means for US firms as they navigate the LIBOR transition process during 2021.

The bill, it is hoped, will prove crucial to solving a key transition process challenge – minimising litigation risk. Prior to the bill being passed, both counterparties would have to agree on a benchmark rate, which is not as simple as it sounds. If one party does not agree on the change it could result in litigation, and with a looming deadline, it will be a herculean task to resolve – and one that will require additional time, money, and resource.

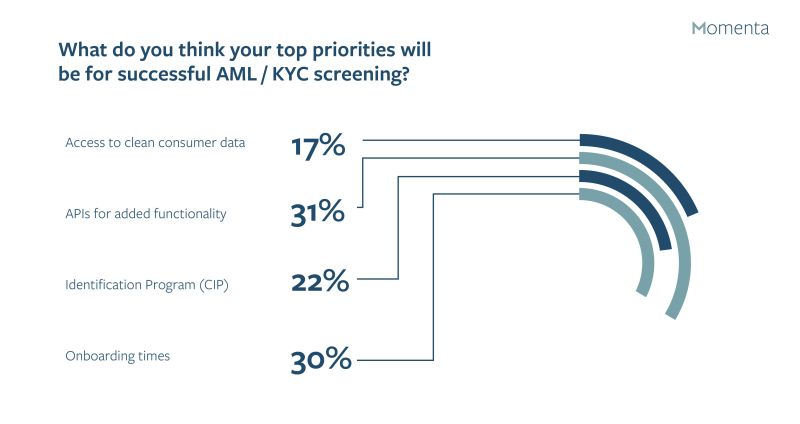

In our recent poll, we asked what your priorities will be for successful AML / KYC screening, and many of you said APIs for functionality. 31% of respondents felt that this added functionality was a top priority in allowing firms to ensure they have embedded successful AML/KYC screening into their wider business processes.

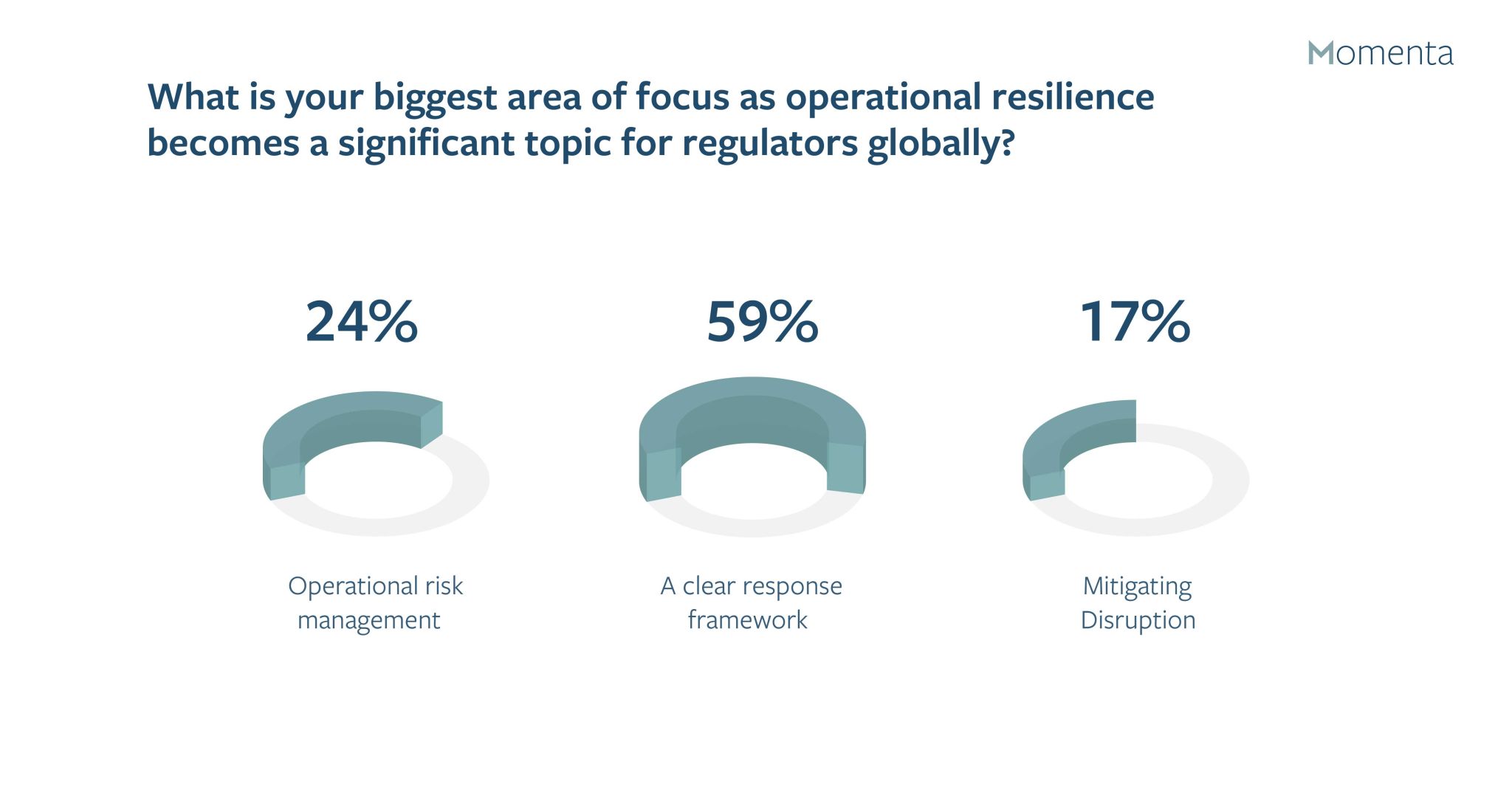

We recently ran a survey across our media channels and asked which area a priority of your businesses was in order to improve operational resilience.

With this topic being a significant point of interest for regulators globally, we were interested to see that 59% of respondents highlighted a clear response framework as their main area of concern.

Momenta were tasked by a bank to resource a Project Manager with key LIBOR experience to ensure a smooth transition process, in accordance with key regulatory and policy requirements.

One of the client’s biggest challenges was that of re-papering and fallback language. As the new RPR’s are calculated differently from LIBOR, contracts created under the new rates differed from those under LIBOR rates.

All customers needed to understand any charge incurred to their contracts, and if this wasn’t executed in an appropriate manner, the bank could see several serious legal implications because of misinforming, incorrectly updating, and not accurately discussing the transition with their customers.

Read more to find out how we dealt with this task and the ultimate outcome for our client.

The post-COVID-19 world will present enormous amounts of opportunities for those who are prepared, and many are starting their preparations to transition into new market norms now, by equipping themselves with flexible, experienced, and effective contingent workforces.

To find out how Momenta can help you with your contingent workforce planning and resourcing, contact us today.