This month, we will look at the latest trends and movements in the world of financial compliance and track the up-to-date developments within the global AML/KYC space, with all the most recent regulatory implementations and updates addressed and dissected.

2022 is sure to see a plethora of further regulatory change with even more risk and potential for financial crime being imposed on banks. With that in mind, it’s never been more vital for financial institutions to ensure they’re on top of all their regulatory requirements and responsibilities.

Read on, for all the very latest key market updates, trends, and industry leader insights that you need to know this month.

The Financial Conduct Authority has released the results of a multi-firm investigation into financial crime controls at challenger banks. The FCA conducted the evaluation in 2021 in response to the National Potential Assessment of money laundering and terrorism financing released in 2020, which highlighted the risk that challenger banks’ rapid onboarding processes would appeal to criminals.

The FCA’s investigation found that technology is being used effectively to promptly identify and verify consumers and that the financial crime risks faced by challenger banks and those faced by traditional retail banks are similar. However, at the onboarding stage and beyond, there are various places where improvements might be made. All challenger banks have been asked to study the FCA’s recommendations and put them into practice.

Risk and compliance personnel, particularly those that specialise in financial crime compliance, are still in short supply in the financial services industry. Securing a qualified staff of compliance specialists, forensic investigators, and legal professionals has never been more crucial in a globally connected, complicated, and highly regulated financial system that is navigating the increasing wave of FinTech and cryptocurrencies.

While there has always been a great need for this type of skill, it has gotten even more competitive in today’s job environment. So, what skills will the financial crime fighters of the future need to best prepare for future threats and financial crime attacks?

From March 2020 to March 2021, the three main Covid loan programmes – bounce back, CBILS, and a larger loan scheme, CLBILS — distributed roughly £80 billion to businesses over a 15-month period.

The largest initiative, Bounce Back, distributed £47 billion to 1.6 million people who could borrow up to £50,000 each. Meanwhile, fraud losses were estimated to be around £4.9 billion at the end of March, though PwC, the government’s hired accounting firm, has subsequently revised its estimate to £3.5 billion.

Banks that want to preserve their finances generally do extensive credit checks to prevent fraud and ensure that consumers can repay their loans. However, amid pressure from the Treasury to speed up loan distribution, it was eventually agreed that checks would not be as stringent as normal.

Over the past weeks it has been clear that the pressing need to get that money into the economy took priority over lengthy CDD and AML checks. Borrowers had to affirm that they were affected by Covid and were based in the United Kingdom, that they were in business as of March 1, 2020, and that they were not insolvent as of December 31, 2019. However, applicants were required to self-certify that they met these requirements.

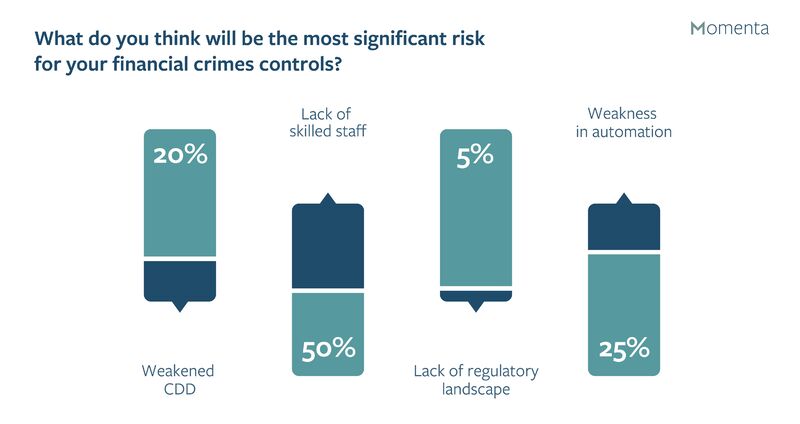

We asked our community what they thought the most significant risk of their financial crime controls would be.

The results showed that 50% of respondents believe that having a lack of skilled staff poses the greatest risk to their financial crime controls.

The post-COVID-19 world will present enormous amounts of opportunities for those who are prepared, and many are starting their preparations to transition into new market norms now, by equipping themselves with flexible, experienced, and effective contingent workforces.

To find out how Momenta can help you with your contingent workforce planning and resourcing, contact us today.