This month, we will look at the latest trends and movements in the world of financial compliance and track the up-to-date developments within the global AML/KYC space, with all the most recent regulatory implementations and updates addressed and dissected.

2022 is sure to see a plethora of further regulatory change with even more risk and potential for financial crime being imposed on banks. With that in mind, it’s never been more vital for financial institutions to ensure they’re on top of all their regulatory requirements and responsibilities.

Read on, for all the very latest key market updates, trends, and industry leader insights that you need to know this month.

Over the past year or so, the advantages of a contingent workforce have become abundantly clear. The global recruitment landscape has evolved from the great resignation to the great reshuffle, and we are seeing changing landscapes in global hiring models.

So, what does this mean for contingent workers and what type of hiring trends should they look out for over the next year?

Global news update: Staff shortages brought on by Covid are crippling the Australian economy, with banking, financial services, and professional services firms in dire need of skilled talent.

In the Banking and Financial Services Sector, there is still a shortage of risk and compliance experts, particularly those with expertise in financial crime compliance. It has never been more important to hire a trained team of compliance experts, forensic investigators, and lawyers in the complex, highly regulated, international financial system navigating the wave of FinTech and Cryptocurrencies.

Overwhelming regulatory and policy demands from increased AML/CTF requirements and heightened cyber threats have meant that additional staff support was and is very much needed. Firms want more flexibility in their talent investments, but they’re also dealing with a scarcity of specialised talents. As a result, new hiring models are including contingent talent as part of new hiring strategies, to help in areas of weakness or areas where they do not have enough in-house capacity to cope with the additional demands.

Read more on why the importance of contingent workforces cannot be overstated.

Have you downloaded our latest global financial crime report?

Regulatory bodies are adopting a more proactive approach as the 6th AML, ASIC, and APRA plans focus on cybersecurity and cryptocurrency. The US anti-corruption strategy will exert pressure on businesses worldwide. Businesses need to be more responsible as the regulatory burden rises. Penalties have become more severe, and businesses must comply to avoid financial crimes.

Recent regulatory developments have emphasised identifying UBOs. The UBO regulation will be more volatile in the UK, US, and Australia, among the countries with quite diverse populations. The UK, Australia, the US, the EU, and many other countries have imposed economic sanctions on Belarus and Russia in response to the invasion of Ukraine in February 2022.

The in-house workforce is often not good at handling compliance matters well. Modern-day compliance requires optimised data collection. The challenge to remain compliant while maintaining business profitability is now greater than ever. As per a FATF digital transformation survey, over 80% of participants hailed cutting-edge technology usage for AML/CFT matters.

Download the full report to understand the latest trends in regulatory financial crime markets and how to circumnavigate compliance regulatory landscapes of anti-money laundering laws in the UK, the US, and Australia.

Global Webinar Update:

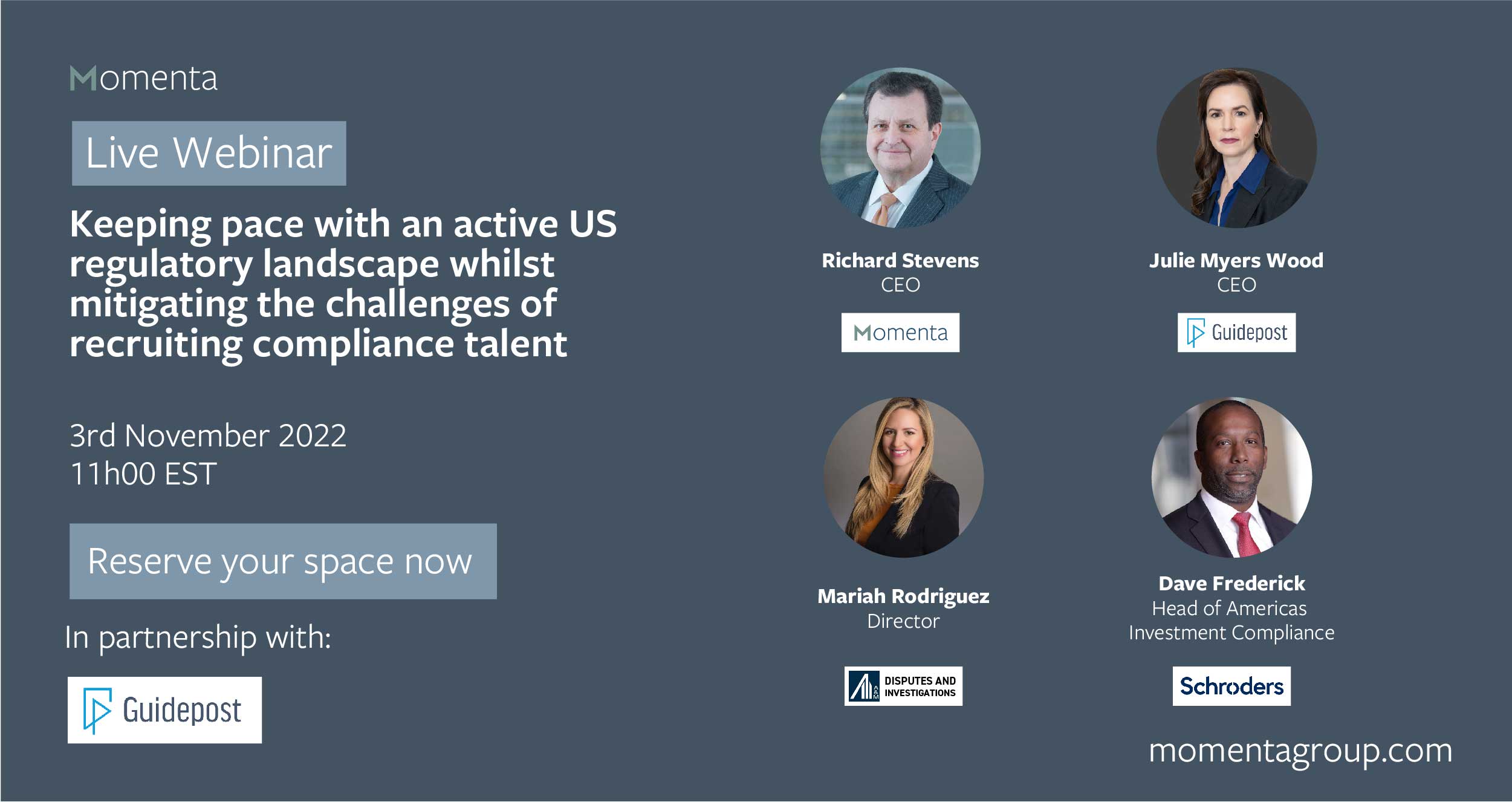

Join us for our upcoming free webinar on Keeping pace with an active US regulatory landscape whilst mitigating the challenges of recruiting compliance talent.

The compliance environment is becoming more complex with increased risk for organizations, as they try to strike a balance between upholding compliance whilst ensuring they have the right talent to keep pace with new AML regulatory reform.

The following three years will be challenging for compliance specialists in US institutions, as they try to manage staffing levels in an ever-shifting regulatory environment that calls for more volumes and implementation of regulatory change.

This webinar examines how compliance teams can utilize contingent staffing techniques to keep businesses compliant during a time of increased regulatory reform and additional pressures placed on already stretched compliance teams.

Key learning objectives:

– Understanding the new regulatory reform

– Managing staffing levels and how to cope with increased volumes and implementation of regulatory change in ever shifting regulatory environments

– Understanding the potential risks associated with the Great Resignation and solutions to alleviate staffing issues and costs.

– Implementing contingent staffing techniques to help compliance teams manage key areas such as board governance and third-party risk management.

Panelists:

- Mariah Rodriguez, Director, Alvarez & Marsal

- Dave Frederick, Head of Americas investment Compliance, Schroders

- Richard Stevens, CEO, Momenta

- Julie Myers Wood, CEO, Guidepost

The post-COVID-19 world will present enormous amounts of opportunities for those who are prepared, and many are starting their preparations to transition into new market norms now, by equipping themselves with flexible, experienced, and effective contingent workforces.

To find out how Momenta can help you with your contingent workforce planning and resourcing, contact us today.