Motor finance: your key steps to operational readiness

9 May, 2025

The motor finance sector has been in the regulatory spotlight recently, specifically concerning the potential requirement for remediation and redress of Discretionary Commission Arrangements (DCAs) and the emerging challenge of increased complaints relating to Affordability and Irresponsible lending. Momenta’s experts explore the main challenges and advise on the next steps for firms to improve their long-term compliance.

DCA review

The FCA confirmed in March that it’s likely to consult on a redress-only scheme should the Supreme Court rule that customers were affected by widespread failings relating to DCAs. The statement provides clarity to firms by all but removing the likelihood of a customer complaint-led approach.

With the Supreme Court looking to finalise its ruling in the next month, and the FCA planning to communicate the detail of their approach within the six weeks following this, Momenta experts consider the actions firms should be taking now in readiness for these decisions.

Affordability and Irresponsible lending complaints

Our insights from working with leading motor finance providers show that firms are already seeing a surge in complaint volumes relating to Affordability and Irresponsible lending. Primarily driven by Claims Management Companies (CMCs), these additional complaint points sit outside the FCA and Supreme Court DCA review – and therefore require immediate action.

The ability to respond effectively to these challenges will determine financial, operational, and reputational outcomes.

Operational Readiness

Firms should start preparing for a proactive redress scheme relating to DCA sales, and the impending surge in complaints relating to Affordability and Irresponsible lending.

No matter where your firm is on the journey, here are some critical readiness steps that can be acted on immediately:

- Defining the affected customer base – Which customers/customer groups are in scope for redress? Are there gaps or anomalies in existing data points that need resolving? Keep in mind that historic legal documentation may be incomplete and subject to GDPR constraints.

- Processes, procedures and training– Are your processes and procedures compliant with the latest regulations and suitable to scale? Design efficient processes with well-governed procedures and training material to support correct customer outcomes.

- Customer contact and communications strategy– What is the approach to contact customers? Defining outreach processes, contact templates and customer tracing methods is essential. Develop communication plans for the inevitable increase in customer contact points across multiple channels.

- Operational planning– Are operational teams prepared for the increase in demand? Operational plans should include customer service and other areas not directly linked to the processing of customer redress. Plan a complete scenario response to deal with varying volumes across business areas.

- Automation, workflow and reporting – Start to consider how technology can deliver the most efficient, accurate and cost-effective way to remediate large customer populations. Develop workflow processes and reporting tools that provide control, visibility, and allow for accurate reporting to the regulator and internal stakeholders.

Be prepared with the right support

Navigating the regulatory challenges is complex, so enrolling the support of independent experts can help you get up to speed, faster.

At Momenta, we understand the complexities of the FCA DCA review and Supreme Court decisions. Our expertise and tailored solutions will ensure your firm navigates regulatory challenges efficiently and is set up to deal with the operational challenges ahead.

Regulatory Expertise: Our experience in resolving highly complex regulatory challenges means we can advise your business every step of the way towards delivering a compliant project with correct customer outcomes.

Automation and AI: By integrating our purpose-built tech solution, we can streamline processes, deliver greater accuracy, and reduce cost. This allows your business to scale efforts and manage high volumes while maintaining accuracy and compliance.

Proven Execution: We have delivered over 50 remediation projects from start to finish, driving timely and accurate results. Our team mobilises resources quickly, ensuring efficient and compliant project execution so that you can focus on core business priorities.

Our tailored solutions are designed to help you stay compliant, resilient, and operationally efficient throughout this challenging period.

Momenta’s proven advisory and resourcing models

Our tailored advisory and resourcing models ensure the timely provision of resources to expertly manage both regulatory risk and fluctuating volumes of work.

Advisory service

- Our industry experts can be deployed to support your firm’s preparations to design efficient processes, manage risks and ensure appropriate measures are taken to achieve compliance with the regulator.

- Working to support you both strategically and operationally, our experts provide a wrapper of expertise to ensure your business gets it right, first time.

Resource augmentation

- Our resource augmentation model aims to supply high quality experienced resource into your existing teams.

- Resources are engaged on rate-per-day contracts, and all types of roles can be supported and deployed swiftly in line with any intake plan you may have.

- Using Momenta resources provides significant flexibility, with the ability to give people 10 working days’ notice.

Managed service

- Going beyond simply deploying resources to your firm to be managed by you – as a part of our tailored managed service offering, we also provide all operational control and oversight to ensure that your objectives are delivered.

- We create a delivery plan that works for you. Alongside quality and risk management frameworks, operational management, and produce real-time reporting on all deliverables.

- We offer a highly competitive pricing structure, with the flexibility to choose from various models including Fixed Price, Cost-per-case and Time & Materials.

Offshore teams

- Whilst traditionally focused on providing high-quality resource in the UK, we’re also able to offer a cost-effective, offshore operation. Underpinned by Momenta’s mission to deliver excellent customer outcomes, this service offers real value to our clients.

- Our solution enables the design, implementation, and execution of a high-quality solution, which is backed by Momenta’s in-depth expertise and is fully assured by our UK leadership and delivery teams, with c40% cost savings.

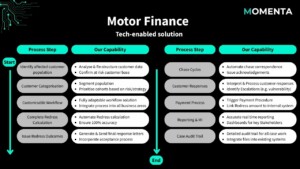

Tech-enabled solution

As firms prepare for the scale and complexity of potential DCA-related redress, harnessing the power of technology will allow firms to react quickly whilst remaining compliant.

The diagram below illustrates how our purpose-built tech solution can drive efficiency, accuracy, and cost-effectiveness across the full case lifecycle.

Whether this is through a redress-only scheme, or to respond to increased complaint volumes, our solution is fully adaptable to your needs, supporting every stage with speed and precision.

What next

Whilst we await the impending decisions of the Supreme Court and consequential FCA action, it’s clear that motor finance firms face a challenging period with operational impacts likely to be felt through either increased complaint volumes, and/or the need for remediation and redress.

Being prepared for these challenges will put your firm on the front foot, ensuring an efficient, compliant & cost-effective delivery.

Given the scale of these demands, regulatory expertise, resource augmentation and delivery support are essential.

Check out some of our case studies to see how we have delivered for our clients.

Motor Finance Discretionary Commission Arrangement (DCA) Claims Case Study

Motor Finance Provider – Complaints Resolution

No matter where your firm is on the journey, get in touch with us to ensure that your business gets it right, first time.