How Can Trusts and Company Service Providers Comply with Tranche 2?

It is likely that trust firms will need to comply with stricter anti-money laundering regulations in the future. With several key changes set in place for trusts and service companies, this insight highlights key changes that are expected to be implemented, and is a preliminary look into how frequently Trust and Company Service Providers (TCSP)s have been utilised to carry out money laundering operations will be reviewed as well as how trusts and company service providers can align their operations with AML/CFT Tranche 2.

About trusts and company service providers

Financial mediators – known as Trust and Company Service Providers are crucial to the international economy as they provide a vital link between financial firms’ clients and the general public. and as a result, they greatly influence how transactions move through the Global financial process.

Numerous studies have highlighted the recourse to legal entities and contractual structures to contribute to money laundering. Trusts and company service providers need to stay vigilant while engaging in business activities involving potentially dubious activities.

How does money laundering via corporations work?

Money laundering activities often trace back to trusts and service provider organisations which is why trust and service providers need to detect and deter money laundering and terrorism financing. Multiple case studies confirm the following criteria as having a significant impact on the offence of money laundering:

- In some countries, weak or inadequate AML/CFT regimes exist in areas that affect how TCSPs function.

- The existence of individuals in the TCSP sector who are prepared to engage in or commit crimes.

- The growth of TCSPs with administration or employees who lack the necessary skills, experience, or understanding of crucial topics essential to the functioning of their firm, such as the affairs of their clientele. This lack of information and expertise may encourage and make illegal behaviours easier.

AML guidelines for corporations in Australia

A documented AML programme that has been authorised by the company’s board of trustees orgoverning body inside the organisation will be necessary for trust firms to develop and administer.

AML obligations in Australia

Under the AML/CTF Act (and associated legislation), firms operating within this legislation in Australia must meet the following key compliance steps:

- Register with AUSTRAC

- Develop an AML program

- Report to AUSTRAC

- Keep AML records

AML compliance best practices in Australia

The AML/CFT compliance needs vary from firm to firm. Below are examples of best practices which may help enhance compliance:

- Customer relationship management: Firms should employ automated CRM systems that help them perform regulatory aspects of customer relationships, for example, client data management, AML/CFT risk assessments, and customer onboarding, .

- Identity verification: Firms can use ID verification platforms to enhance the CDD process. This way, firms are able to verify the identities of their customers to conduct accurate AML risk assessments. Plus, manual compliance is much slower than digital identity verification.

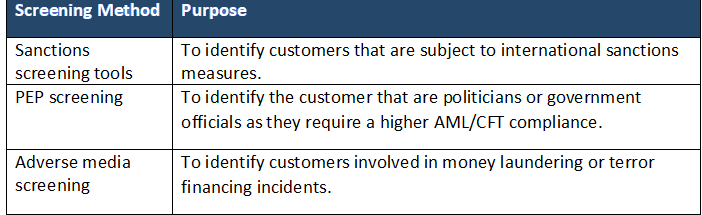

- AML/CFT screening: Advanced customer screening tools check different AML/CFT obligations. For example, Australian firms can integrate the following:

- Transaction monitoring: Checking the transactions of customers can help firms identify suspicious activities hinting towards money laundering and terror financing. For example, transactions with high-risk countries and too many transactions are suspicious activities.

- Case management: Case management systems (CMS) help firms facilitate the timely submission of SARs to AUSTRAC, and the remediation of AML alerts.

- Social network analysis: Social Network analysis tools are helpful for internal money laundering investigations. SNA tools enable firms to point out links between different profiles.

Momenta’s contingent workforce for compliance of TCSPs

Momenta works with companies across multiple industries worldwide to successfully build their contingent workforce. If you are a trust or service provider company with additional regulatory or compliance pressures, Momenta can assist with staffing support for your claims handling and risk/compliance departments. Speak to us to see how we can help in supplying experienced and effective members to your team.

Using the expertise of Momenta’s contingent resourcing can offer many firms breathing space in terms of resolving the issues their AML controls may have. Establishing the right teams to ensure any gaps are found will be key for firms as regulators place additional pressure on financial service participants to strengthen current compliance systems and controls.

Organisations like Momenta Group are addressing genuine issues in AML/CFT based on 30 years of experience collaborating with small and large companies. The solution to common compliance concerns is an experienced outsourced workforce. Momenta is ready to provide a small or large contingent team to big and small companies. We offer skilled and experienced industry experts with in-depth knowledge about the continuously changing requirements of various sectors.

Works Cited

-

Attorney’s General Department, Australian Government. Consultation Paper Trust and Company Service Providers: A Model for Regulation under Australia’s Anti-Money Laundering and Counter-Terrorism Financing Regime 2. 2016.

-

Cameron, Sarah. “AML in Australia: What You Need to Know.” ComplyAdvantage, 23 Sept. 2022, complyadvantage.com/insights/aml-australia/. Accessed 9 Dec. 2022.

-

FATF. “FATF Guidance for a Risk-Based Approach for Trust and Company Service Providers.” Www.fatf-Gafi.org, www.fatf-gafi.org/en/publications/Fatfrecommendations/Rba-trust-company-service-providers.html. Accessed 9 Dec. 2022.

-

FATF. “Money Laundering Using Trust and Company Service Providers.” Www.fatf-Gafi.org, www.fatf-gafi.org/documents/documents/moneylaunderingusingtrustandcompanyserviceproviders.html. Accessed 9 Dec. 2022.