Are you prepared for AML regulatory reform in the US?

Until now, the United States and its territories have had sole responsibility for the establishment and administration of legal entities. However, a lack of transparency has led to an increase in financial crimes, specifically money laundering and fraud.

The next three years will present several challenges but will also offer opportunities to compliance professionals in US financial institutions and will highlight the ever-increasing need for contingent staffing methods in ensuring that firms remain compliant.

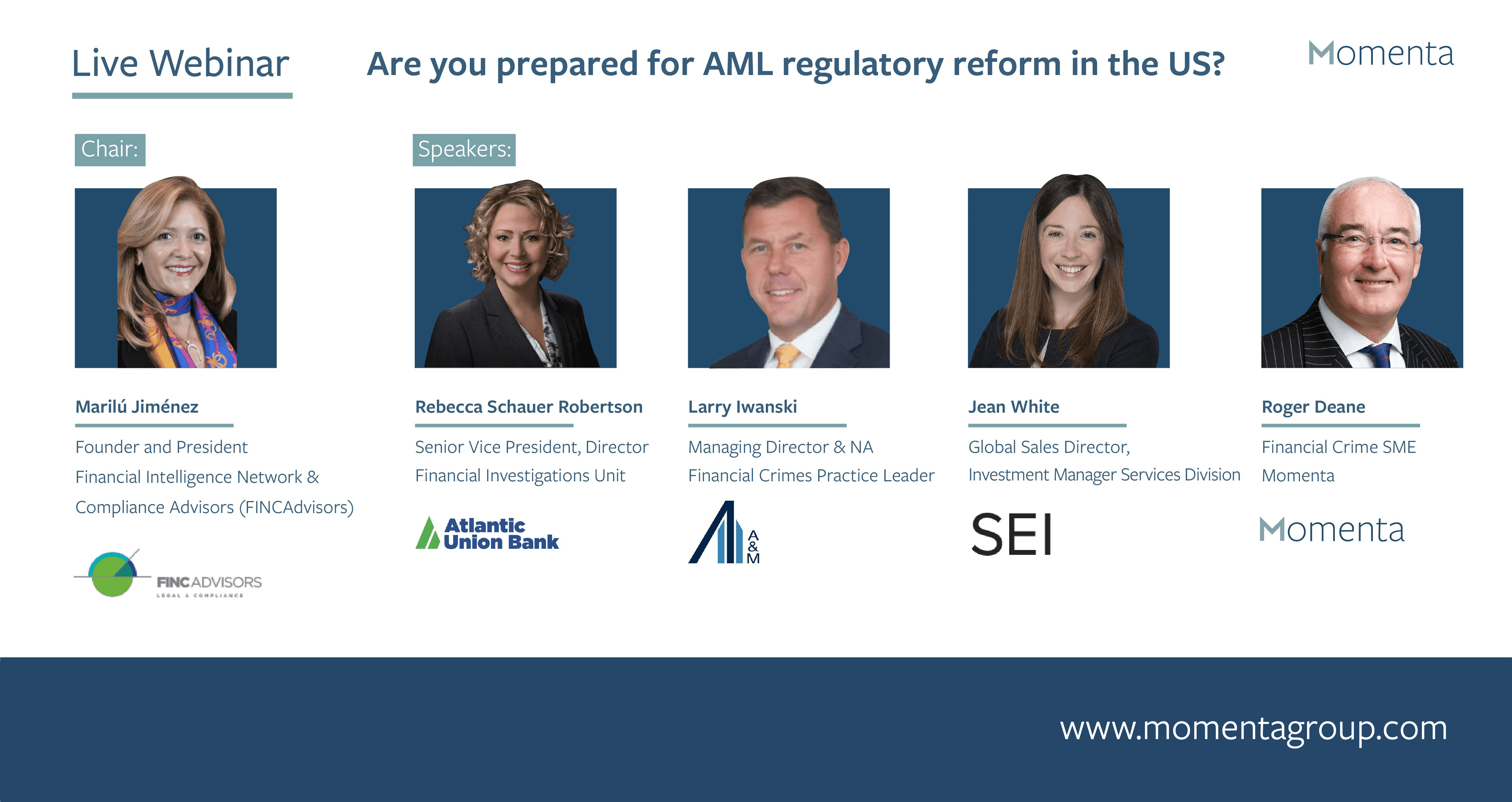

In our recent webinar, Momenta teamed-up with a panel of industry experts to explore whether firms AML systems are equipped for the new regulatory landscape, and if they are prepared for significant changes to KYC AML regulations.

The event covered a wide range of topics and we were delighted on the day to have so much live interaction form our audience in the form of some thought-provoking and challenging questions for our panel of experts.

You can listen to the full event here – Download Now.

This 60-minute event is a must listen for all regulatory and compliance professionals in the US. Below, we have summarised just a small selection of some of the points covered by each of our event speakers on the day.

Rebecca Schauer Robertson, Senior Vice President, Director Financial Investigations Unit, Atlantic Union Bank, raised several key points:

- The AML Act changes the landscape of the Bank Secrecy Act. After its inception, up until now, the most drastic change of the regulation was the implementation of the USA Patriot Act in 2001. Fast forward 20 years and the AML Act became the most substantial revision to this law since 2001, expanding the objectives of the BSA in the process.

- There are varying degrees of what and when mandatory compliance will look like and when the mandatory compliance states will be. Rebecca stated that all market participants can adapt quickly, but not always effectively or efficiently. As guidance has not been published yet, firms will have to start thinking through what is this really going to look like for them to comply?

- Compliance with beneficial ownership has been very onerous for financial institutions, affecting more than one area from implementing sustainable procedures.

Our next speaker, Larry Iwanski, Managing Director & NA Financial Crimes, Practice Leader, Alvarez & Marshal, highlighted the key takeaways from some of the recent conversations that he has had with some industry leaders and law enforcement professionals as it relates to the new act.

- The first point Larry wanted to make clear was ‘don’t panic’. There is significant time before the final implementation.

- Fix the fundamentals. Larry suggested that firms need to look at the fundamentals of their programme.

- The designation of an individual or individuals that are responsible for the monitoring and training of appropriate people will be key.

- The business must have reasonable belief, that it knows the identity of its customers, the donors, the vendors, any other parties that the company has financial transactions with.

Our next speakers looked at a combination of technology and expertise. Roger Deane, Financial Crime SME, Momenta and Jean White, Global Sales Director, Investment Management Division, SEI, gave us some very specific food for thought, including:

- According to a report by Deloitte, 59 % of businesses are outsourcing to reduce their expenses, which certainly accounts for one of the reasons that this area is growing.

- Firms are trying to run as lean as possible and do not necessarily have the people that they can immediately turn to to set up, run and manage projects.

- For many companies, legacy I.T. systems are often simply not agile enough to respond to all the changes that are required by a shift in regulation or just to support specific remedial projects.

- Therefore, turning to an outsourced provider to expedite a project, particularly when there is regulatory pressure, is becoming more the norm.

- It is commonplace for firms to seek both people and a technology solution to either deal with a one-off project or to form a specific turnkey business support function which is integrated into the general business model.

- The last 10 years or so has also seen a much greater appetite for companies to use external resources and teams to handle some of what we might refer to as the more sensitive projects that previously in the past might have been kept in house.

Jean expanded on the tech landscape, and highlighted:

- Given the continually changing legislation in this space, as well as the different appetite for risk that underlying clients have, it is important to have something that can assimilate change into production very quickly.

- Regulatory authorities are constantly changing and evolving the legislation to make sure that they keep things in check, so technology really needs to be able to adapt to change in that way.

- Underlying risk appetites of different clients varies hugely. Flexibility from a tech perspective is fundamental. You will need a solution that also combines expertise and headcount at the very least along with technology. So as a standalone solution is insufficient.

Finally, our Chair for the event, Marilú Jiménez. Founder and President, Financial Intelligence Network & Compliance Advisors (FINCAdvisors), summarised the panel discussion by stating that this legislation focuses on the following themes:

- Codification of the risk-based approach.

- Modernisation through technology and innovation.

- Streamlining lower value processes.

- Expanding enforcement and investigation related authority, beneficial ownership, is one of the biggest parts of this legislation.

- Emphasis on coordination, cooperation and information sharing between financial institutions and regulators.

You can listen to and watch the full event, including all the above points being discussed and expanded upon in full detail by simply downloading our free webinar recording now.